“That’s some bad hat, Harry”

– Chief Martin Brody, Jaws, 1975

It is the golden anniversary for the summer blockbuster. The movie that began the wave of packing theaters during the summer was Jaws, which is still the seventh highest grossing movie of all time on an inflation adjusted basis. The genius of the film that captivated audiences during the summer of 1975 is the direct antithesis of what we have come to expect from suspense and horror movies today. What had so many people afraid to go in the water that summer was not the shark itself – it does not fully appear until 1 hour and 21 minutes into the movie and is only shown on screen for a cumulative total of 4 minutes. It is the fear of what and where we think the shark could unexpectedly be. It is the unknown that we cannot see but can only imagine driven by the iconic soundtrack music literally dictating our heart rates to increasingly accelerate with fear (duuuunnnn duun, . . .).

The same principles are playing out in financial markets fifty years later as I write. Ahead of last Friday’s market open, Israel launched surprise military strikes against Iran, badly damaging their nuclear and military apparatus. Financial markets understandably recoiled on the news, with the S&P 500 dropping by more than -1% on Friday while safe havens such as Treasuries and gold rallied. The market reaction is being driven by fear – fear of the unknown that we cannot see but can only imagine with the drumbeat of military fire and the notion that these attacks and counterattacks could lead to the outbreak of full-blown war across the Middle East and potentially the world. It is geopolitical risk playing itself out real-time. What is an investor to do?

It’s all psychological. The fear is completely understandable. But financial markets do not have sympathy. Can they be emotional? Oh, hell yeah – ridiculously so at times. But emotions are not the same as sympathy. What drives stock market performance? Economic growth, inflation staying under control, corporate earnings, and abundant liquidity to keep the gears of the markets sufficiently lubricated at all times. A terrorist attack? The outbreak of war? People dying on the battlefield? Innocent civilians caught in the crossfire? All of these things are tragic and weigh on the human psyche. But financial markets aren’t human. And frankly they do not care rightly or wrongly.

Is the economy going to be adversely affected? Most likely not.

Is it going to spark an outbreak of inflation? Sure, oil prices spiked by over +7% on the news, but both West Texas Intermediate and Brent Crude had been trading lower virtually all year until Friday. The price spike on Friday did nothing more than bring oil prices back to even year to date. Another thing, the U.S. gets most of our imported crude from Canada, Central and South America – only a small fraction comes from Saudi Arabia, Iraq, and Nigeria. So unless we’re talking about a surprise attack on Alberta sometime soon, the answer here is also most likely no.

Is this attack going to hit corporate earnings? If tariffs haven’t in any meaningful way so far, this almost certainly isn’t. Only 0.3% of domestically produced goods and services in the U.S. find their way to the Middle East. Less than 0.001% to Iran. Answer – nah.

What about market liquidity? If anything, the outbreak of geopolitical conflict can be read as a positive sign by financial markets from a liquidity perspective. Why? Recognizing that the outbreak of a geopolitical conflict can create uncertainty, central bankers are often inclined to inject extra liquidity into the financial system to ensure everything keeps functioning properly.

Putting this all together, financial markets on the margins may ultimately rally on net in the wake of this geopolitical news. Cue the Jabberjaw “I don’t get no respect!” catchphrase.

Amity. But couldn’t the conflict escalate and eventually cause disruptions on all of these fronts listed above? Perhaps, but even if it does, remember that markets are driven by liquidity arguably more than anything else. And history has repeatedly shown that financial markets simply just don’t care if a war is going on, no matter how bad and bloody the conflict may be.

To illustrate this point emphatically, let’s go big. The first example is the terrorist attacks of September 11, 2001. We’re not talking about a surprise attack in the Middle East here. Instead, we’re talking about an unprecedented military surprise attack on the United States of America that among other things demolished two of the tallest buildings in the world that literally resided at the heart of the global financial system. It is the World Trade Center after all. Markets were closed for four trading days in the aftermath of the attack, only to reopen the following Monday (9/17). Yet after five days of heavy selling, the market rallied for much of the next nine trading days to return to pre-9/11 levels. Stocks continued to rally in the weeks that followed, moving well above pre-terrorist attack levels. And this was a sustained rally that was taking place in the midst of the bursting of the tech bubble. What was the primary driver of this quick rebound at the time? The Fed and policy makers injected massive amounts of liquidity into the financial system immediately following the terrorist attacks to ensure that markets continued to function properly.

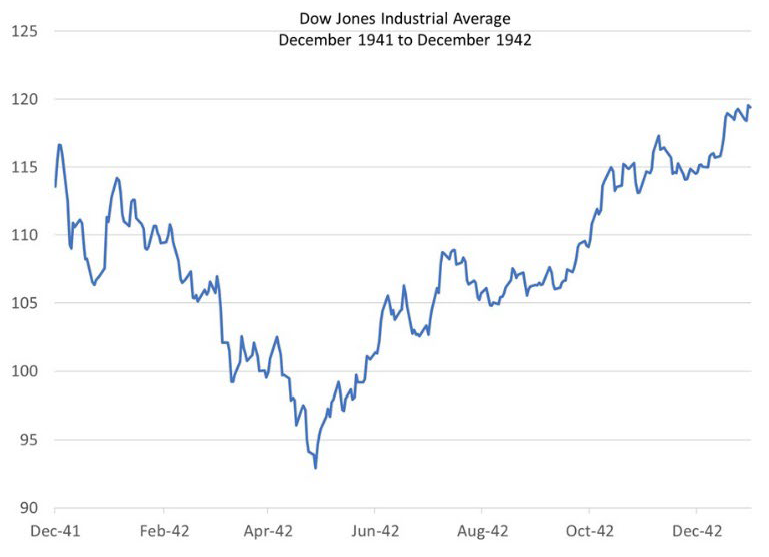

Let’s go back even further in time to arguably the biggest geopolitical threat of all. On December 7, 1941 the Japanese bombed Pearl Harbor, thrusting the United States into World War II. This attack occurred as the U.S. economy was still struggling to make its way out of the Great Depression. Basically, we did not know at the time and would not know for years whether we would win or lose a world war. Did the Dow Jones Industrial Average initially pullback following the attack? Yes. Was it trading effective back at pre-Pearl Harbor levels by early January 1942? Notably, yes. Did stocks proceed to trade lower by over -18% over the next four months through the end of April 1942? Yeah, but remember our list above – the U.S. economy had to quickly shift to a wartime economy and corporate profits were squeezed in the short-term due to the rapid and massive resource reallocation. And oh yeah, there was that pesky Great Depression thing that still weighed heavily on investor sentiment (in contrast to today’s “buy the dip, the markets always go higher” sentiment, the investor mood in the early 1940s after more than a decade of repeatedly getting their teeth kicked in by stocks was decidedly more pessimistic). Nonetheless, by April 1942, US stocks bottomed. By October 1942, stocks were trading well above pre-12/7/41 levels. And by the end of World War II, US stocks had more than doubled. In short, we were on the brink of potentially losing our sovereignty in a global war, and the stock market was finding a way to rally strong.

Indianapolis. An important “yeah, but” should be discussed before closing the book on veritable shark attack on financial markets. What about the Russian invasion of the Ukraine? Did US stocks fall into a bear market in the wake of the surprise attack starting on February 24, 2022? Yes, but we must remember the context. U.S. stocks had already peaked earlier in the year on January 4. More specifically, the tech stocks that had been driving the post COVID market euphoria had peaked several weeks earlier just before Thanksgiving 2021. The reason was that the U.S. economy was developing a scorching case of inflation that got started all the way back in February 2021 and kept getting worse and worse and worse despite the Fed’s repeated insistence that the burning would only be temporary. In short, we already had inflation bad in the US and the Russian invasion only piled on even more inflation bad. It was the veritable cherry on top of the US inflation sundae that was getting served with piping hot chocolate sauce for more than a year already before the Russians stepped a foot into Ukraine.

Even with all of this, US stocks still found the gumption to rally by 13% in the immediate aftermath to trade well above pre-invasion levels for a spell before persistent economic and corporate earnings realities further set in. What was the final dagger to push markets lower? The U.S. Federal Reserve finally stepping in to AGGRESSIVELY raise interest rates to combat the inflation problem left to fester for so long. In short, the Fed was rapidly draining liquidity from the financial system. Less liquidity – bad for stocks. While this is what was happening in 2022, this is not at all what is taking place today.

Bottom line. Markets are understandably reacting to the latest outbreak of geopolitical conflict, this time in the Middle East. But history has repeatedly shown that any such short-term market reaction to the downside should be viewed as a potential buying opportunity going forward. Despite what the financial headlines may be signaling, it is still safe to go into the financial market waters.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Investment advice offered through Great Valley Advisor Group (GVA), a Registered Investment Advisor. I am solely an investment advisor representative of Great Valley Advisor Group, and not affiliated with LPL Financial. Any opinions or views expressed by me are not those of LPL Financial. This is not intended to be used as tax or legal advice. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Please consult a tax or legal professional for specific information and advice.

LPL Compliance Tracking #: 755313